Refund of the excise duty

1. Excise duty includes:

By the definition refund includes rebate of duty paid on goods exported out of India or on materials used in the manufacture of goods exported out of India.

2. Timeline:

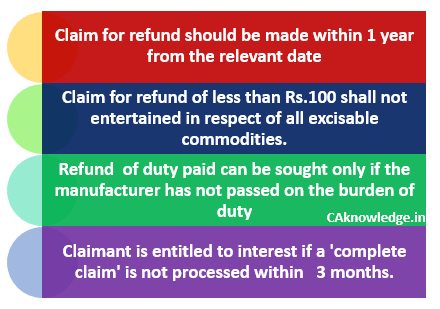

The refund claim can be filed within one year from the relevant date. Section 11 defines what relevant date is.

3. Application to whom:

Application of refund has to be submitted in the specified form by an assessee or a person who has borne the incidence of the duty to the Deputy/Assistant Commissioner of Central Excise having jurisdiction over the factory of manufacture. 4. Shift of burden: A manufacturer can go for the refund of the duty only when he has not passed on the burden of the duty. In case the burden of the duty has been passed on the refund can be claimed by the person by whom the duty is actually paid.

How to present the refund claim:

- If a person deems himself eligible for refund or get any information from the department about his entitlement of the refund of any duty of the excise or other dues, then he has to present a claim in the specified form to the deputy/assistant commissioner of the central excise along with a copy to the range officer. He has to support his claim with all relevant documents as required by the law. This claim has to be presented in duplicate signed by the claimant or by duly authorized person on behalf of him along with a revenue stamp on the original copy wherever necessary.

Removal of Goods as Such – Excise RulesArrest and Bail Under Service Tax and Excise NotesDownload Latest Central Excise Forms – UpdatedClassification of Excisable Goods

- How important the accompanying relevant documents are: Depending upon the nature of the documents it may be considered by the department as the claim presented is incomplete if it is not supplemented by relevant document as said in the act. As per the central excise act if the claim is not processed within 3 months from the date of actual claim made, the claimant is eligible for interest. In the cases of incomplete claim the case may not be considered for this purpose. So it is very essential to submit all the relevant documents along with the refund claim.

Process of sanctioning the refund:

- Range officer: After the claim is presented by the claimant the range officer will scrutinize the claim papers within a period of 2 weeks from the date of receipt of the claim and prepares a report which will be submitted to Deputy/assistant commissioner of the central excise.

- Divisional deputy officer: Deputy Officer will scrutinize the claim in consultation with the range officer. He will check whether the claim is complete in all respect along with the relevant documents. In his scrutiny if needs clarification for any point involved in the claim then he will point out the same to the claimant with a copy to the range officer within 15 days of the receipt.

- Divisional office will do the final processing of the claim after thoroughly going through the range officer’s report. They verify whether assessee has passed on the incidence of the duty to anyone. If the divisional office finds that the burden has already been shifted to the buyer then it may order to credit the claim to the consumer welfare fund.

Payment:

Soon after the claim has been admitted whether in part or in full, and claimant is eligible for refund, Deputy/Assistant Commissioner of Central Excise should ensure that payment is made to the party within 3 days of the order passed after due audit if any. This will be paid to the applicant by way of a cheque drawn on the sanctioning authority’s bank account.